how long does coverage normally remain on a limited-pay life policy

This policy lets you pay premiums for only a specific period such as 20 years or until age 65 but insures you for your whole life. Annual renewable term This gives you coverage for one year with the option of renewing it each year for a specified duration such as 20 years.

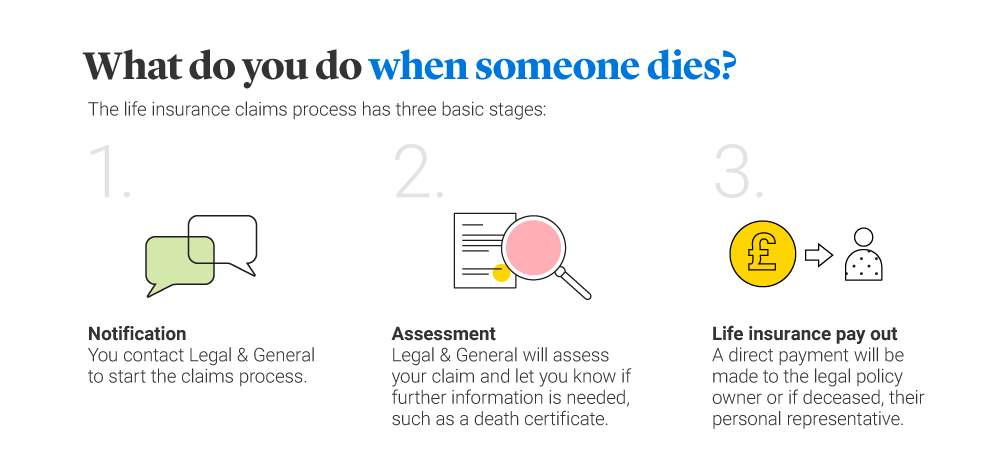

How Do Life Insurance Pay Outs Work Legal General

Guaranteed cash value grows tax-deferred.

. Match your term length to your financial situation. A Limited-Pay Life policy has. Coverage however remains in force for the insureds lifetime.

How long does the coverage normally remain on a limited-pay life policy. Also the shorter the pay period the more faster you will accumulate cash value. Paid Until Age 65.

For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy. Age 100 20 A term life insurance policy matures upon the insureds death during the term of the policy Decks in Insurance Class 3. Some pay it with one single premium.

Limited payment whole life insurance. At the beginning of the sixth year the premium will increase to 800 per year but will remain level thereafter. Which of these would be considered a Limited-Pay Life policy.

How long does the coverage normally remain on a limited-pay life policy. How long does the coverage normally remain on a limited-pay life policy. Continue paying Part A deductible if you havent paid the entire amount No coinsurance for first 60 days.

Premiums are payable for as long as there is insurance coverage in force. When you purchase the policy the premiums will be locked in for the life of the policy as long as you pay them. This is the main reason that term insurance is far less expensive than whole and universal life insurance.

For example lets say you buy a whole life insurance policy at age 40. 10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100. If you are thirty years old and purchase a twenty year policy then the premium and life coverage will last until you are 50 years old.

The insureds total loan value. With this policy your rates go up every year that you renew and are calculated based on. There are several things that impact how long you can stay on claim and receive long-term disability benefits.

The amount of coverage on a group credit life policy is limited to. If G were to die at age 50 how long would Gs family receive an income. Call MaineCare Member Services at 1-800-977-6740 for.

If the policyholder dies of a covered cause while coverage is. Most term life insurance policies last 10 20 or 30 years but some companies offer additional five- or 10-year increments up to 35- or 40-years. The amount of coverage on a group credit life policy is limited to.

If you get the service or the medical equipment without MaineCares approval you may have to pay the bill. You can pay premiums monthly quarterly semi-annually or annually. What kind of premium does a Whole Life policy have.

Single premium whole life insurance. In the SNF continue paying the Part A deductible until its fully paid. In other words rather than paying your insurance premiums in perpetuity you agree to pay them in full over a pre-specified time.

A term life insurance policy is a type of insurance in effect for a limited time such as 20 or 30 years. Premiums are payable for as long as there is insurance coverage in force. Fewer than 60 days have passed since your hospital stay in June so youre in the same benefit period.

Examples of services and medical equipment that need PA. The insureds total loan value. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime.

Limited pay life insurance is a type of whole life insurance policy that is structured to only owe premiums for a set number of years. Premiums are payable for 10 15 or 20 years depending on the policy selected. This article will discuss a few of these things including definitions of disability benefit limitations and the maximum benefit period but it is important to read your long-term disability policy in order to understand your specific coverage.

The amount your insurance company will pay your beneficiaries if you die while the policy is active. Term Life Insurance- Term is a policy that you decide how long yopu want to keep it when you buy it. Most people buy it for either 1-years 20-years or 30-years.

As a result premium payments will be higher than if payments were spread out through your lifetime. The face amount will. Limited pay policies are sometimes referred to as 10-pay 15-pay or 20-pay life depending upon the number of years premiums are to be paid.

Term life insurance coverage lasts for a limited period of time. If you try to keep term life insurance too long you will pay a. This is pretty simple to explain.

A limited pay policy is whole life insurance that requires premiums only for a specified number of years or to a specified age of the insured. Life Paid-Up at Age 70. M purchases a 70000 Life Insurance Policy with premium payments of 550 a year for the first 5 years.

For questions about a PA for a prescription drug call the Pharmacy Help Desk at Pharmacy Help Desk at 1-866-796-2463. As a general rule of thumb fewer years results in a higher annual premium. With the limited pay life insurance option you pay premiums in the early years of ownership but the benefits.

Most people pay a premium on whole-life their entire lifetime but many will pay it in full within 10-years or 20-years. As long as you pay your premiums your whole life insurance policy will stay in effect and your premiums will remain the same regardless of health or age changes.

Purchase Price Allocation Ppa Deloitte Netherlands

What Is Life Insurance And How Does It Work Moneyfacts Co Uk

What Is Term Life Insurance Money

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Pin By Toolstation On Diy Quick Dry Metal Shed Quick

What Is Whole Life Insurance Cost Types Faqs

New York Life Insurance Review Whole And Universal Life Valuepenguin

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Aaa Life Insurance Review No Exam Policies And Discounts Valuepenguin

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Types Of Life Insurance Explained Progressive

Three Key Questions To Ask About Internet Marketing By Olaf Fischer Http Myartsubmit Com 212378 What Is Internet Questions To Ask Internet Marketing

Three Key Questions To Ask About Internet Marketing By Olaf Fischer Http Myartsubmit Com 212378 What Is Internet Questions To Ask Internet Marketing

Is Whole Life Insurance Worth It Bankrate

What Is Life Insurance Exact Definition Meaning Of Life Insurance

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)